The Cash Value Bank Masterclass

The Private Collateralized Banking System the Wealthy Have Used for 100+ Years!

The Wealth Blueprint

Your Financial Advisor Won’t Teach You!

Not Just Salaries. Not Just Struggle.

If there were a way to move

your money off the tax radar,

make it work twice as hard, and

keep it in the family for generations…

would you want to know?

Taught by Jeff "The Wealth Builder" Moore, with 27 Years of Financial Strategy Experience.

Tuesday, Oct. 7th, 7pm

The Problem

You make good money. You’ve broken barriers. You’re the first in your family to hit six figures.

But here’s the truth:

Your 401(k) locks up your money until retirement.

Your bank pays you crumbs while using your cash to get rich.

You don’t have a system to build, protect, and pass down wealth.

High income doesn’t equal wealth.

And the financial system is designed to keep it that way.

In this free masterclass, you’ll discover:

How to unlock money without penalties, taxes, or permission.

The secret to multiplying money while it’s still liquid.

The 4 Pillars of Indestructible Wealth. Liquidity, Leverage, Legacy, and Control.

Why Cash Value Wealth Builders move different, and how you can too.

Discover the system the top 1% use to create wealth, fund investments, and pass on a legacy, all without asking the bank for a dime.

Here's What You'll Learn:

How to turn your salary into your own private bank

Why the wealthy never use their own money, and how you can do the same.

Why me and a selective few don’t lose sleep over taxes, inflation, tariffs, or politics.

The only guaranteed method to preserve and protect your heirs.

The same strategy Walt Disney used to fund Disney World, a 187 billion dollar business, and how you can use the same strategy today.

The secret to keeping money liquid, protected, and growing at the same time.

My 4 Pillars of the CVB Method

These pillars form the foundation of a financial strategy designed for First Generation High-Income Earners to get control of their money, reduce & or eliminate taxes and create generational wealth.

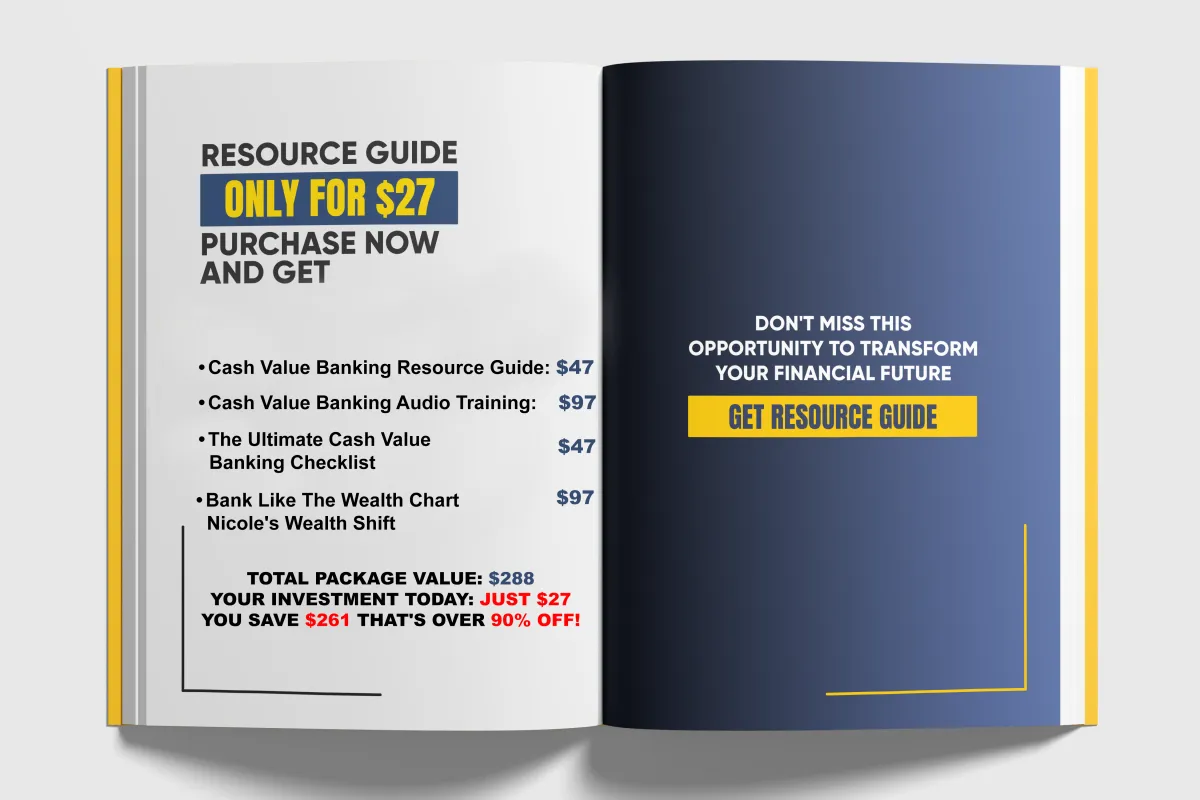

Enhance Your Masterclass Experience with the CVB Resource Guide

Why It's a Must-Have

Deepen Understanding

Break down complex concepts of the CVB Method™ into digestible insights.

Practical Application

Engage with interactive worksheets and real-life scenarios to apply what you learn.

Ongoing Reference

Keep this guide handy for continuous consultation as you implement the CVB Method™ in your financial strategy.

What's Inside

In-depth explanations of Liquidity, Leverage, and Control principles.

Interactive worksheets to assess and plan your financial approach.

Case studies illustrating a successful implementation of the CVB Method™.

Customized action plans tailored to your financial goals.

For just $27, you can add the CVB Resource Guide to your registration, transforming your learning experience from passive observation to active application.

Who This Is For

This masterclass is not for beginners or people still figuring out how to make money.

This is for you if:

You’re earning $100K+

You’re the first in your family to build real income

You want to structure your money like the top 1%

You’re legacy-minded and tired of market drama

You believe in building wealth for your community, not just yourself

MEET Your Host

Hey, I am Jeff Moore!

With over 25 years in financial services, I’ve helped countless high-income earners create liquid, tax-free, and legacy-level wealth using the CVB Method, a system that helps you

own the bank instead of renting it.

I don’t lose sleep over inflation, taxes, or the stock market anymore.

And after this masterclass, you won’t either.

April 22, 2025, 8PM EST

Bank Like the Wealthy

Without Wall Street, High Fees, or Permission

Discover the system the top 1% use to create wealth, fund investments, and pass on a legacy — all without asking the bank for a dime.

Here's what You'll Learn:

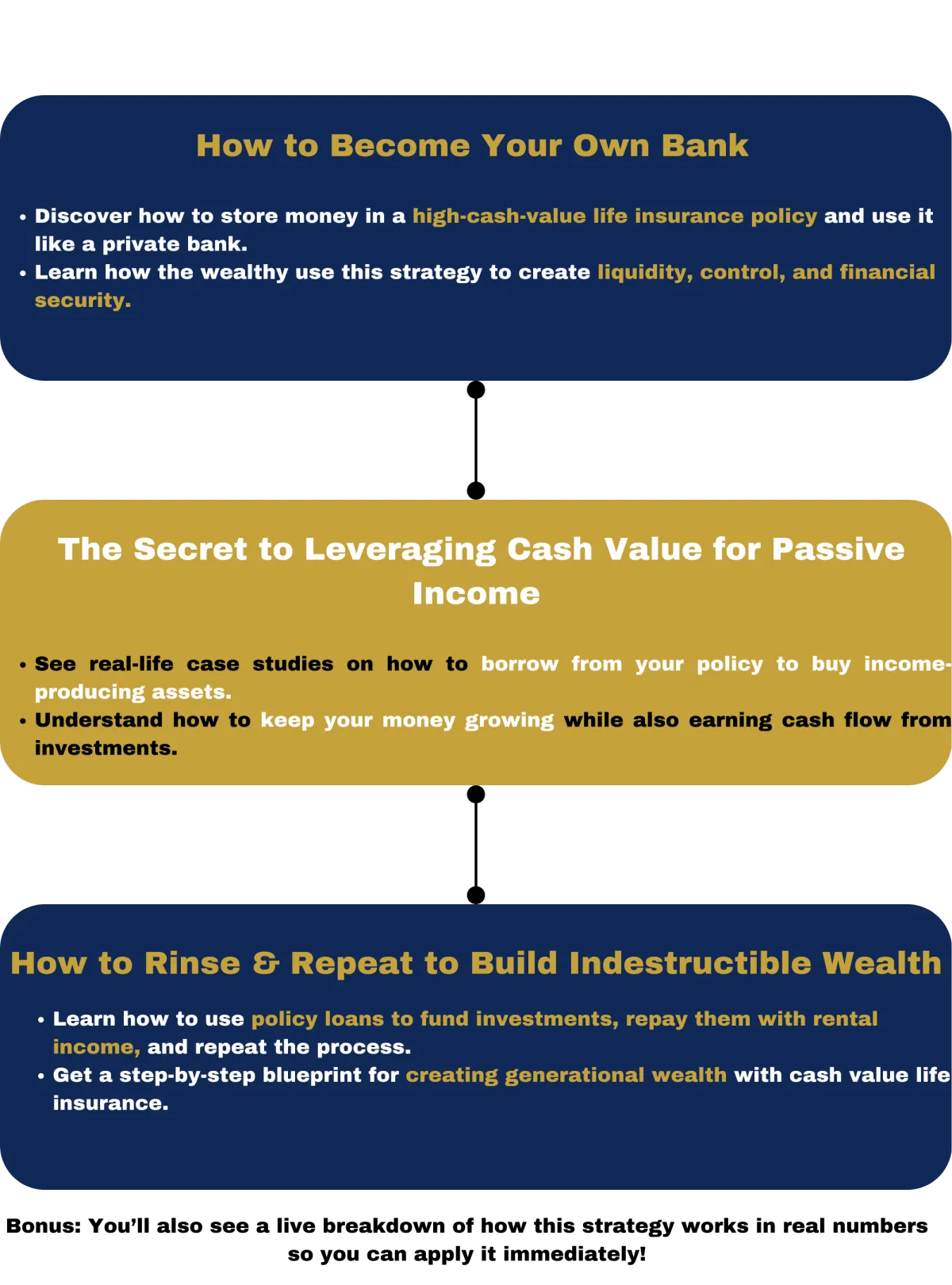

Master the Art of Cash Value Banking:

Discover how to leverage your income to create your own banking system, turning every dollar into a step towards lasting wealth.

Break Free from Traditional Constraints:

Understand why conventional banks limit your financial potential and how you can bypass these restrictions to achieve true financial freedom.

Reinvestment Strategies That Work:

Learn actionable techniques for reinvesting your money, ensuring it works as hard as you do—accelerating your wealth growth exponentially.

Step-by-Step Blueprint for Building Your Empire:

Gain access to a detailed roadmap that shows you exactly how to set up and manage your personal bank, from saving to investing.

Real-Life Success Stories & Proven Tactics:

Hear inspiring testimonials from successful first-generation high-income earners who’ve revolutionized their finances and get practical insights you can implement immediately.

Meet the Two Types of Wealth Builders

The Traditional Saver:

You diligently save a portion of your income, relying on traditional banks and low-interest savings accounts. While this approach is safe, it often yields minimal growth, making it challenging to build substantial wealth over time.

The Cash Value Banking Strategist:

You take control of your financial future by creating your own banking system. By leveraging advanced strategies, you make your money work harder, achieving exponential growth and true financial independence.

Which path will you choose?

April 15, 2025 | 8:00pm EST

But let me stop you right there...

In 2008, I watched my retirement accounts crash. Thousands gone overnight.

Stocks fell. Real Estate Values tanked. Business Values Tanked. Friends panicked. But one thing kept growing…

My life insurance policy — the only asset I had that still paid me guaranteed interest and dividends during the chaos.

That was the moment I stopped trusting the system… and started Becoming My Own Bank.

Now I teach first-generation high-income earners exactly how to use dividend-paying whole life insurance to:

Protect income

Get Guaranteed Returns

Borrow from themselves

Invest on their own terms

And build indestructible wealth

This is not theory. It’s the blueprint the banks and brokers hope you never find out about.

If you’re serious about becoming your own bank — this is the first step.

The Cash Value Banking Resource Guide shows you exactly how to set up, grow, and leverage your own personal banking system without giving up control.

Click below to download your guide, join the masterclass, and book your 1-on-1 call — for just $27.

This is your invitation to stop guessing, stop gambling, and start building a financial system that pays you now and later.

This isn’t theory.

It’s been working for 100+ years.

No market risk. No taxes on growth. No penalties for access.

Just smart strategy that the wealthy have quietly used for decades.

But now — you get the keys.

A comprehensive guide on leveraging dividend-paying whole life insurance policies to create a self-sustaining financial ecosystem.

This consultation will provide tailored advice to align the strategies from the guide with your unique financial situation, setting you on a path to financial independence.

Don't miss this opportunity to transform your financial future.

Invest in the Resource Guide today and take the first step toward becoming your own banker.

Here’s What You’ll Learn in this Masterclass...

Each day is built to fast-track your mindset, uncover your strengths, and give you step-by-step systems to create recurring income.

Ready to turn your ideas into consistent cash flow?

April 15, 2025 | 7:00pm EST

Meet Your Host

Jeffrey A. Moore is the CEO of Moore Financial Solutions, a boutique financial services firm in Mount Laurel, NJ.

Moore Financial Solutions is on a mission to help 5,000 individuals and families build enormous Cash-Value Life Insurance contracts over the next 10 years to Leverage real estate, stocks, and business ownership opportunities.

Jeff has been in the insurance and financial services industry for 26 years. He is passionate about teaching financial literacy and has helped countless professionals and entrepreneurs get control of their money, build tax-free income, and leave an inheritance to the next generation.

Jeff graduated from Penn State University with bachelor's and master’s degrees.

Favorite Quote: Someone is Sitting in "The Shade Today Because Someone Planted a Tree A Long Time Ago." - Warren Buffet

Jeff Moore

Who Is This Masterclass For?

Our "Become Your Own Banker" masterclass is tailored for individuals seeking to gain greater control over their financial futures by understanding and Becoming Their Own Bank.

This masterclass is ideal for:

First-Generation High-Income Earners:

Professionals and entrepreneurs who have achieved substantial income and aim to manage and grow their wealth effectively.

Individuals Seeking Financial Independence:

Those who desire autonomy over their finances, moving away from traditional banking systems to self-reliant wealth management.

Savvy Investors and Financial Planners:

Individuals interested in diversifying their financial strategies and exploring innovative methods for wealth accumulation and preservation.

Business Owners and Entrepreneurs:

Business-minded individuals looking for alternative financing options and efficient ways to manage cash flow within their enterprises.

Anyone Eager to Learn About Infinite Banking:

Individuals curious about the principles of Becoming Their Own Bank and how to apply them to achieve long-term financial goals.

By participating in this masterclass, attendees will gain valuable insights into transforming their financial approach, empowering them to take charge of their wealth-building journey

Why You Should Register Now!

Seizing the opportunity to join our "Become Your Own Banker" masterclass now offers several compelling benefits:

Immediate Access to Wealth-Building Strategies: Learn how to leverage the Infinite Banking Concept (IBC) to take control of your finances, potentially leading to long-term wealth accumulation. ibcfinancial.com

Exclusive One-on-One Consultation: Receive personalized guidance to tailor the IBC principles to your unique financial situation, enhancing the effectiveness of your wealth-building plan.

Comprehensive Resource Guide: Gain access to our "Become Your Own Bank" Resource Guide, offering in-depth insights and actionable steps to implement IBC successfully.

Limited Availability: With limited spots available, acting now ensures you don't miss out on this transformative opportunity to reshape your financial future.

Empowerment Through Knowledge: Equip yourself with financial strategies that traditional banks may not disclose, empowering you to make informed decisions and achieve financial independence.

By joining now, you position yourself to take immediate control of your financial destiny, utilizing proven methods to become your own banker.

Listen To What Others Are Saying

Frequently Asked Questions

What is the Cash Value Banking Concept?

The Cash Value Banking concept is a financial strategy that leverages dividend-paying whole life insurance policies to create a personal banking system.

How does Cash Value Banking differs from traditional banking?

Unlike conventional banking, where control over finances is limited, Cash Value Banking empowers individuals to be their own bankers.

By utilizing the cash value of whole life insurance policies, policyholders can finance their needs, ensuring that interest payments benefit them rather than external institutions.

Why haven't I heard about Cash Value Banking before?

Several factors contribute to the limited awareness of Cash Value Banking.

Recent Popularization: Nelson Nash introduced the concept in his 2000 book, "Becoming Your Own Banker. Few financial professionals are well-versed in Becoming Your Own Bank leading to less widespread dissemination.

Traditional financial advice often emphasizes external control over personal finances, contrasting with Become Your Own Bank's principles.

Who can benefit from practicing Cash Value Banking?

Cash Value Banking is suitable for individuals seeking financial autonomy, including:

Business Owners: To manage cash flow and investments internally.

Real Estate Investors: For financing properties without traditional loans.

Families: Aiming to build and preserve wealth across generations.

Why use whole life insurance for Cash Value Banking?

Whole life insurance is integral to Cash Value Banking due to its features:

Guaranteed Growth: Cash value increases over time, unaffected by market volatility.

Liquidity: Policyholders can access funds through loans against the cash value.

Tax Advantages: Potential for tax-deferred growth and tax-free loans.

How do policy loans work within Cash Value Banking?

Policy loans allow you to borrow against your policy's cash value:

Access: Typically, available within the first year of the policy. Charged by the insurance company, with rates varying by provider.

Repayment: Flexible terms set by the policyholder, with unpaid loans reducing the death benefit.

Are there risks associated with Cash Value Banking?

While Cash Value Banking offers numerous benefits, potential risks include:

Policy Lapse: Failure to meet premium payments can result in policy termination.

Loan Mismanagement: Excessive borrowing without repayment can diminish policy value.

Initial Costs: Whole life policies may require higher initial premiums compared to term life insurance.

How can I get started with Cash Value Banking?

To begin practicing Cash Value Banking:

Educate Yourself: Read foundational materials like "Becoming Your Own Banker" by R. Nelson Nash.

Consult a Professional: Seek guidance from a financial advisor experienced in Become Your Own Banker.

Assess Financial Standing: Evaluate your finances to determine suitability and readiness.

Listen To What Others Are Saying

Frequently Asked Questions

What is the Become Your Own Bank Concept?

The Become Your Own Banking concept is a financial strategy that leverages dividend-paying whole life insurance policies to create a personal banking system.

How does Become Your Own Bank differs from traditional banking?

Unlike conventional banking, where control over finances is limited, Become Your Own Bank empowers individuals to be their own bankers.

By utilizing the cash value of whole life insurance policies, policyholders can finance their needs, ensuring that interest payments benefit them rather than external institutions.

Why haven't I heard about Become Your Own Bank before?

Several factors contribute to the limited awareness of Become Your Own Bank.

Recent Popularization: Nelson Nash introduced the concept in his 2000 book, "Becoming Your Own Banker. Few financial professionals are well-versed in Becoming Your Own Bank leading to less widespread dissemination.

Traditional financial advice often emphasizes external control over personal finances, contrasting with Become Your Own Bank's principles.

Who can benefit from practicing Become Your Own Bank?

Become Your Own Bank is suitable for individuals seeking financial autonomy, including:

Business Owners: To manage cash flow and investments internally.

Real Estate Investors: For financing properties without traditional loans.

Families: Aiming to build and preserve wealth across generations.

Why use whole life insurance for Become Your Own Bank?

Whole life insurance is integral to Become Your Own Bank due to its features:

Guaranteed Growth: Cash value increases over time, unaffected by market volatility.

Liquidity: Policyholders can access funds through loans against the cash value.

Tax Advantages: Potential for tax-deferred growth and tax-free loans.

How do policy loans work within Become Your Own Bank?

Policy loans allow you to borrow against your policy's cash value:

Access: Typically, available within the first year of the policy. Charged by the insurance company, with rates varying by provider.

Repayment: Flexible terms set by the policyholder, with unpaid loans reducing the death benefit.

Are there risks associated with Become Your Own Bank?

While Become Your Own Bank offers numerous benefits, potential risks include:

Policy Lapse: Failure to meet premium payments can result in policy termination.

Loan Mismanagement: Excessive borrowing without repayment can diminish policy value.

Initial Costs: Whole life policies may require higher initial premiums compared to term life insurance.

How can I get started with Become Your Own Bank?

To begin practicing Become Your Own Bank:

Educate Yourself: Read foundational materials like "Becoming Your Own Banker" by R. Nelson Nash.

Consult a Professional: Seek guidance from a financial advisor experienced in Become Your Own Banker.

Assess Financial Standing: Evaluate your finances to determine suitability and readiness.